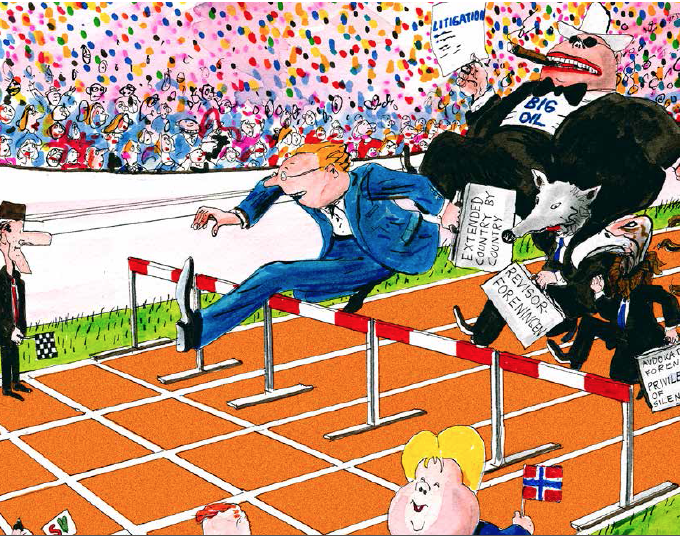

The Government only needs to close three loopholes to make the legislation to combat corruption and tax flight work.

This opinion piece is authored by Mona Thowsen, Secretary General of PWYP Norway. It was published in the newspaper Dagens Næringsliv (“DN”) on September 24, 2014.

The Government wants to prevent tax flight, we read in DN on September 10, 2014. That sounds good, but so far the Government and the Ministry of Finance have in actual fact been blocking the most important initiative that can prevent tax flight, i.e. extended country-by-country reporting.

Flawed regulations

Just before the summer holidays, the Ministry of Finance issued regulations supplementing the legislative initiative to combat corruption and tax flight; extended country-by-country reporting. The Ministry of Finance was by that time well appraised of three obvious loopholes in the legislation that make it easy for companies to avoid tax. It nonetheless chose to retain these weaknesses.

Three red flags

The current status in Norway is that 15 of 18 elements of the "extended" country-by-country reporting proposal of Publish What You Pay Norway have been implemented. All the Government needs to do is to close three loopholes to make the legislation to combat corruption and tax flight work:

1. Why should the reporting hide costs?

If a company had reported its cost as part of extended country-by-country reporting, as proposed by PWYP Norway, society would have gained an insight into income, cost, profit and tax. This would have enabled examination of how income and tax relate to investment and cost. Because the Ministry of Finance only required the reporting of ”goods and services” under the regulations, it is impossible to compare income and tax to investment and cost. ”Cost” should therefore be included in the reporting to prevent corruption and tax flight.

2. Why should the reporting be detached from the annual financial statement?

The Ministry of Finance has rewritten the regulations and is merely requesting ”consolidation”. But the most logical approach would be to obtain financial information from the audited annual financial statement of a company. The wording of the regulations may seem innocuous, but it has massive implications in terms of what numbers the general public will get access to. This is not only peculiar, but also totally inappropriate; it will make it virtually impossible to check the numbers reported by companies. We propose that companies break down their annual financial statements by country, which can be done in notes to the financial statement. That would ensure that only real accounting figures are reported.

3. Why should the reporting only involve countries where the physical extraction of natural resources is taking place?

The Ministry of Finance is referring to tax havens as ”support functions”. Companies may currently omit reporting of what they have registered in tax havens. Tax havens are not «support functions», but ”key functions” when it comes to the provision of services that can facilitate corruption and tax flight. PWYP Norway has demonstrated that the extractive industry is a major user of financial instruments that can be misused to transfer income out of host countries before it has been taxed. Tax havens also represent a money-laundering mechanism that contributes to tax flight from resource-rich, but poor, countries.

The Ministry of Finance is allowing for ”other exemptions”, without any restriction, under the regulations. In practice, this opens up the possibility that any exemption whatsoever may be made at any given time. The US and the EU do not grant exemptions. Norway is now going against the grain of the international cooperative effort to increase transparency. Norway should close this loophole to ensure that it does not undermine the international effort to prevent tax flight.

Us and them

DN recently wrote that Google only paid NOK 740,000 in tax in Norway last year. This was based on advertising sales of NOK 1.5 billion. This is one of the reasons why the Ministry of Finance is calling for «initiatives». But wait a moment: Is it OK for oil companies to transfer non-taxed funds from resource-rich, but poor, countries in the South, whilst it is not OK for Google to transfer non-taxed funds from Norway?

Make demands

The Government must not shy away from making demands on oil companies that are granted access to the natural resources that belong to us all.

In its party programme, the Conservative Party writes that we must make demands on developing countries when it comes to democracy development, good governance and anti-corruption efforts. But what happens when developing country citizens ask Norway to make transparency demands on companies, to prevent them from being bled dry by multinational enterprises and authoritarian regimes? The absence of such demands is an obstacle to good governance and democracy development and holds back the effort to prevent tax flight.

It is therefore important to take global steps in the right direction, and the OECD has presented seven initiatives to prevent tax flight. Unfortunately, the OECD initiative suffers from the same weaknesses. On the bright side, the OECD is only halfway into its effort. This means that the Ministry of Finance and the Government can close the loopholes and influence the OECD to do the same, if they are committed to preventing tax flight.

See the opinion piece published at "DN" here. (In Norwegian)